Here’s the brand new trailer for Ron Howard’s Rush – released in UK cinemas 13th September 2013.

Here’s the brand new trailer for Ron Howard’s Rush – released in UK cinemas 13th September 2013.

Here’s the brand new teaser trailer for ‘The Counselor’ staring Michael Fassbender, Brad Pitt, Javier Bardem, Penelope Cruz and Cameron Diaz. The film tells of a lawyer who gets in over his head in the drug trade and is due for release in the UK on the 15th November.

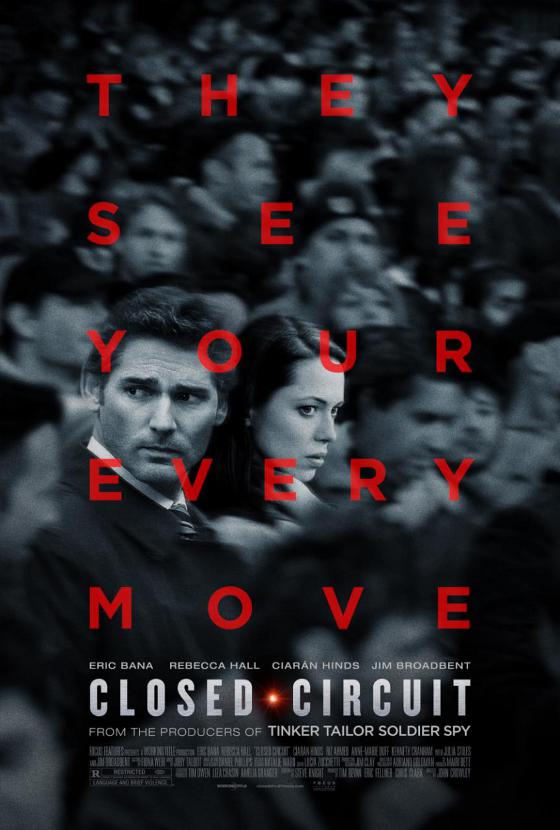

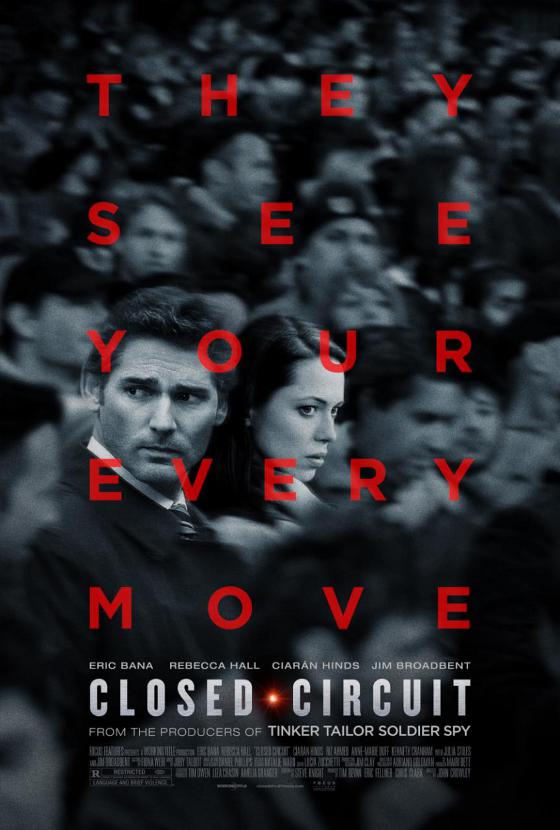

Here’s the brand new poster for ‘Closed Circuit’ staring Eric Bana and Rebecca Hall.In this international thriller, two ex-lovers, Martin (Eric Bana) and Claudia (Golden Globe Award nominee Rebecca Hall), find their loyalties tested and their lives at risk when they are joined together on the defense team in a terrorism trial.

13 June, 2013 | By Anne-Marie Corvin www.broadcastnow.co.uk

Product placement was talked up as a multimillion-pound industry when it became legal in the UK two years ago. Has it lived up to expectations? Ann-Marie Corvin reports

When Ofcom relaxed the rules on product placement (PP) in February 2011, the industry welcomed the news with gusto – which, appropriately, was the name of the first product to receive paid-for airtime on a UK TV show.

ITV’s reported £100,000 deal with Nestlé, which placed its Dolce Gusto coffee machine on This Morning for three months, hailed the dawn of a new era.

Pact predicted that paid-for PP opportunities in TV shows would inject more than £72m into the UK television market “in the short term”, while Barclays Corporate forecast it would be worth £150m a year by 2016.

More recent evaluation by market research company WARC, however, suggests far more modest sums: PP deals in UK television were thought to be worth £2m in 2011 and £5m in 2012.

Most of these deals have focused on established behemoths such as Coronation Street, This Morning, The X Factor, Big Brother and Hollyoaks – shows on which broadcasters can test new business models as they have already proven to be commercially lucrative.

According to Laurence Jones, director of Endemol-owned Initial, the company has more than doubled its PP deals this year, which has brought in “over six figures”. He attributes this to the work it has been doing with C5 on Big Brother: tie-ins with the likes of Morrisons, Schwarzkopf and Touchstone Pictures.

“Big Brother has been the main driver for us,” he says. “One or two shots of a product on that daily show has enabled us to show brands what PP can do for them.”

For lower-profile productions, however, or new series, some argue that PP is not yet worth the effort. “We haven’t done one deal,” says John Nolan, head of commercial programming and digital content at North One.

Nolan believes PP deals are less common among smaller companies because it’s easier for producers to use the established prop-placement model, in which brands (usually via prop-placement agencies) supply TV shows with their products for no profit.

He says: “It’s almost impossible to move to a monetised system when a non-monetised system still works. Producers are suckers for free stuff, and with paid-for, it’s currently just too much hard work to make it work.”

One of the big challenges for those involved in PP is to ensure there is joined-up thinking between the media agency, the broadcaster’s creative, commercial and marketing teams, and the production company.

While Initial does have one new series that has attracted PP (ITV’s forthcoming tropical quiz show Prize Island), Jones acknowledges that it remains a challenge. “It’s complicated,” he says. “It’s about forming creative partnerships with the commercial world and getting them to understand what we’re trying to do.”

For a handful of bigger deals, it may be worth the sweat, but Nolan argues that it is too much effort for the sake of a few grand. “I don’t spend much of my working day shoring up budgets with PP. No one is writing big cheques at the moment, so why bother?”

The whole package

Darryl Collis, director of product placement agency See Saw (which undertakes both paid-for and prop placement deals for brands), says that typically, brands wanting paid-for placements would be advised to commit around £100,000 for guaranteed exposure on a main terrestrial channel.

“For anything less, it’s not worth the effort for all those involved,” he says. However, Jones points out that prop-placement is ad hoc – there’s no guarantee the product will be featured – and, unlike paid-for PP, it’s not an ad platform that can trigger an integrated marketing campaign.

For Lime, producer of Hollyoaks and TOWIE (both of which have attracted substantial PP deals), this type of integration is key. PP usually forms part of a bigger package around sponsorship or ad-funded programming (AFP).

Lime joint managing director Kate Little says: “While they do exist, it is incredibly rare to come across a pure product placement deal. Typically, it may be entered into as part of a sponsorship arrangement.”

However, none of Lime’s deals would have been possible had Ofcom not relaxed its guidelines on PP. An AFP sponsor can now, for the first time, feature its product in the show it wants to fund, a move Nolan welcomes.

“We’ve secured around 100 AFP deals and PP regulations have helped provide a contractual framework for everyone. It’s definitely given us some structure from a compliance point of view.”

Little adds that overall, PP deals tend to be much lower value than AFP. “As a producer, AFP represents a reasonably significant programme funding opportunity, whereas PP revenue is more likely to bridge a more modest gap in an overall programme business plan, or to represent an ancillary or secondary revenue opportunity for the producer/broadcaster.”

C4 partnership leader Rob Ramsey agrees that PP is “central” to the broadcaster’s AFP work. In 2011, New Look and BlackBerry became two of the first brands to take advantage of a PP opportunity on C4 with the ad-funded New Look Style Nation and Live And Lost With BlackBerry.

Ramsay estimates there have been around 50 PP deals since the rules were relaxed; C4 has been responsible for “approximately half of them”.

As a publisher-broadcaster with little in the way of programme IP, it’s not surprising that C4 is keen to own a stake in PP deals. To this end, the broadcaster has invested in research and staff to make sure that PP happens.

Six months ago, C4 interactive sponsorship manager Laura Cottrell became acting partnership business manager for AFP/PP, and the broadcaster is currently seeking a controller to focus solely on AFP and PP deals.

“We think this market will grow and we are investing real resources,” says Ramsey, who likens PP to the early days of sponsorship at C4 “but growing at a faster rate”.

Changing brand perception

The broadcaster conducted research to calculate the exact value of PP following its first slew of deals, and identified brand perception as its biggest impact.

Following Nokia Lumia’s appearance in Hollyoaks over a three-month period, for instance, viewers were more likely to see the smartphone as the best for their social networks; the easiest for one click-pictures and shoot-share; and to have the best range of apps.

The research, which polled around 200 viewers, found PP was welcomed “because it enhanced content credibility by making it more realistic and reflective of everyday life”. “PP produces a halo effect with brand positivity caused by its association with this new ad format,” Ramsey concludes.

When it comes to deals with indies, the split is done on “a fairly substantial basis”, he adds. Trying to ascertain what PP is worth to a brand, and how to measure it, is something with which broadcasters and brands are still experimenting.

ITV is using agency Repucom to monitor and evaluate product placement in its programmes. Metrics include the size of the product, where in the shot it appears, its duration on screen and the number of exposures, the degree of character interaction and whether the brand name is visible.

Repucom has joined forces with digital PP company MirriAd, which places products and signage into TV shows after they have been made.

According to MirriAd chief executive Mark Popkiewicz – a former BBC Ventures director – the service aims to automate the PP process as much as possible, linking finished programmes to brand opportunities. This is then linked to media rates, and finally, a value is attributed to this once the campaign has run its course.

Last year, this technology was used by C4 and Endemol on Deal Or No Deal, which inserted the PG Tips logo onto a mug of tea. The system is also being embraced by broadcasters in the US, Brazil and Italy.

The UK market, Popkiewicz observes, is more conservative. “Most broadcasters in the UK consider PP a dark art where one negotiates a single placement in a single series for nondescript money for unknown frequencies with multiple stakeholders. That’s a lot of work. Broadcasters need to get digital in their thinking so they can create sizeable opportunities,” he says.

Popkiewicz argues that it will be a long time before PP becomes a serious part of a brand’s media plan. Conversely, James Morris, head of MediaCom’s Beyond Advertising division, which looks at content opportunities for brands, argues for a more strategic, less automated approach.

“In terms of the planning process, PP is definitely considered in the mix of a brand’s media plan, but it requires media agencies to be creative on their own to come up with those ideas. Increasingly, we will work more proactively with broadcasters to do this.”

Morris says the most common PP model is for broadcasters’ commercial houses to approach agencies with a package of commercial value to put the product in their show. “It is generally focused around the big entertainment formats, and they tend to come without the programme commissioners or production companies involved. It’s more of a sales-labelling exercise.”

Morris would like to see a more editorial- style PP that requires producers, broadcasters and advertisers to work more collaboratively. Beyond has already achieved this in Germany for its client Hasbro, which wanted to target its foam gun, the NERF blaster, at a young male audience.

“The second series of the German version of The Office was being filmed and we identified an opportunity for the product to appear within this – in scenes when the characters are messing around with the gun at their desks,” says Morris.

Germany sold out of NERF blasters half way through the second series, although the product appeared throughout the run.

Morris also notes that second-screen applications and connected-TV applications are part of Beyond’s clients’ media plans for next year – another development that could give PP an added boost. The possibility of using a second screen or a connected TV to buy or find out more about that coffee machine strategically placed behind Phil Vickery while he makes a shepherd’s pie may just be a click away.

TIMELINE – PRODUCT PLACEMENT DEALS

February 2011

• Ofcom revises its broadcasting code to allow paid-for product placement on UK television for the first time. • ITV’s This Morning becomes the UK’s first paid-for product placement when Nestlé pays a reported £100,000 to place the Dolce Gusto coffee machine onto the daytime show for 13 weeks.

March 2011

• Channel 4 signs first product- placement deal with New Look clothes and branding to appear in T4 fashion show.

August 2011

• Touchstone Pictures signs product-placement deal to feature movie Fright Night on C5’s Big Brother ahead of its theatrical release.

November 2011

• Nationwide cashpoint features in Coronation Street for four months; then renewed for 12.

May 2012

• Hollyoaks signs Nokia product-placement deal. The soap will feature Nokia Lumia smartphones on screen in a four-month deal.

June 2012

• Supermarket chain Morrisons becomes first Big Brother shopping supplier in what is reported to be a “six-fi gure deal” with Initial and C5. • C4 agrees “major product-placement deals” for Uncle Ben’s rice and Yeo Valley yoghurt, both of which feature in Jamie’s 15 Minute Meals.

July 2012

• ITV signs a deal with Welcome to Yorkshire to feature its promotional material in context ually relevant places around Emmerdale.

September 2012

• Galaxy Note 2 has a presence on The X Factor following a deal between Syco, Fremantle and ITV. • ITV and B&Q announce an agreement that includes a new B&Q kitchen on the set of This Morning.

October 2012

• Digital-PP company MirriAd and brand-evaluation company Repucom launch new partnership technology for Deal Or No Deal in the UK.

Jan 2013

• Maximuscle signs PP deal for Celebrity BB. • Very.co.uk products, including branded dressing gowns, are set to feature in the Big Brother house with click-to-buy placement on the Channel 5 website. • DFS sofa makes its first appearance on This Morning. The deal, understood to be worth a low six-figure sum, was brokered by DFS’s media agency MediaCom’s Beyond Advertising division. • Highland Spring becomes first brand to feature in ITV’s Dancing On Ice.

May 2013

• ITV, Lime Pictures and the- 7stars announce an agreement with Ministry of Sound for the first paid-for placement of a brand in TOWIE.

The Royal Princess Launch 13th June 2013

ftp://[email protected]@ftp.tellbetterstories.eu/itvprincess%20coverage.mp4